Solo 401k employer contribution calculator

Individuals 50 years of age and older. For 2019 the maximum amount a self-employed individual can contribute to their Solo 401k is 56000 if he or she is younger than age 50.

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Calculator allows you to calculate the maximum amount you can contribute to your plan.

. When you maintain a 401 k plan solo or other you technically wear two hats. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. Your full 2021 contributions are allowed right up until the Solo 401k contribution deadlines.

Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. To calculate your Solo 401k Plan maximum contribution please input the information in the calculator. For 2021 the max is 58000 and 64500 if you are 50 years old or older.

This is up from 57000 and 63500 in 2020. Complete a Self-Employed 401 k Account Application for yourself and each participating owner including the business owners spouse if applicable. 20500 in 2022 19500 in 2020 and 2021 or 27000 in 2022 26000 in 2020 and 2021 if age 50 or over.

If you are 50 or older you can contribute an extra 6500 bringing your total contribution limit per. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Contribution Limits Your maximum Solo 401k contribution is 57000 per participant per year.

Click on the link below enter requested info below and click the. Contribution limits to a Solo 401k are very high. One as the business owner and sponsor of the plan the other as an employee.

So you definitely want to follow the rules to get the most out of your contributions. As an employee youre. A PDF document will be created that you can print or save.

Contribution Limits for the Solo 401k are very high. For 2021 the max contribution is. I employee deferrals ii employer profit sharing contributions and iii after-tax contributions.

If your business is an S-corp C-corp or LLC taxed as such. There are three types of contributions that can be made to a Solo 401 k plan. For 2021 the maximums are 58000 or 64500 if you are 50 years old or older.

Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan. Plus Employer nonelective contributions up to. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Solo 401k SEP IRA Defined Benefit Plan or SIMPLE IRA.

Contribution to 401 k S x C S x C x E 30000 10 30000 10 50 4500 Since an employers contribution is below 2400 maximum limits we can take. To remove the PDF.

Solo 401k Contribution Calculator Solo 401k

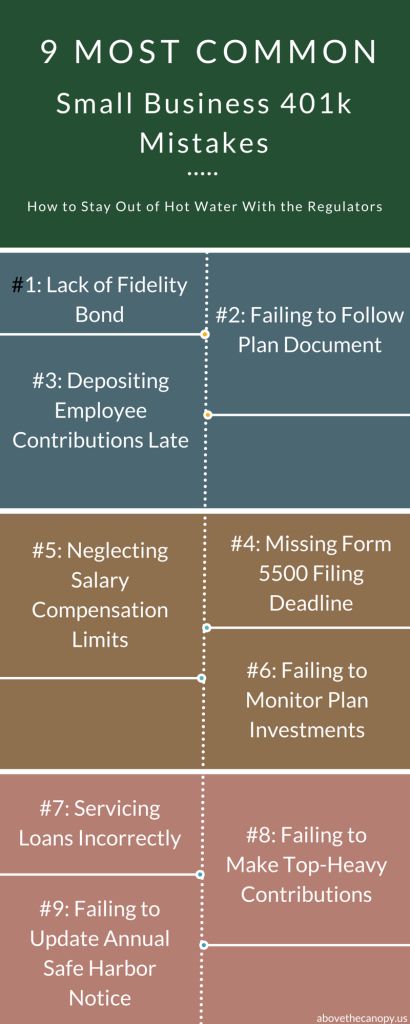

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

401 K Plan What Is A 401 K And How Does It Work

How To Calculate Solo 401k Contributions Self Employed Retirement Plan Youtube

Solo 401k Contribution Calculator Solo 401k

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Employee Stock Options Mistakes That Leave Money On The Table Stock Options Trading Stock Options Investment Advice

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Solo 401k Contribution Limits And Types

401k Calculator

Solo 401k Contribution Limits And Types

Solo 401k Contribution For Partnership And Compensation

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Calculator Solo 401k

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial